The Great House Price Debate

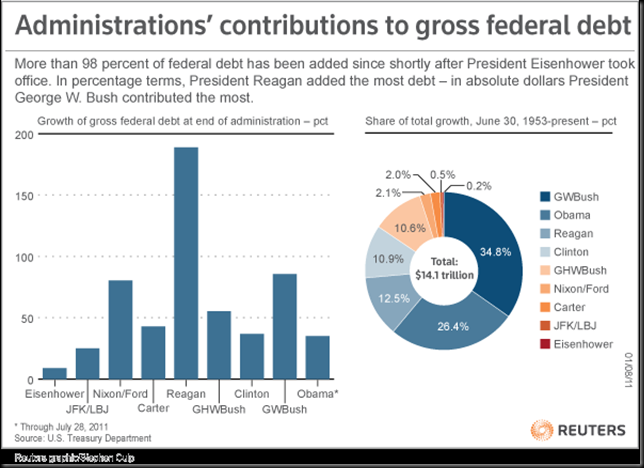

The Governor of the RBA gave an interesting speech in London recently (“The State of Things”, 9/2/11). In addition to scoring some points in terms of how the economic recovery in the Asia Pacific region is proceeding compared to that in Europe and North America, he also used the question and answer session after his speech to mount a strong defence of the current level of house prices in Australia:

There is quite often quoted very high ratios of price to income for Australia, but I think if you get the broadest measures of country-wide prices and country-wide measure of income, the ratio is about four and half and it has not moved much either way for ten years. That is higher than it used to be but it is actually not exceptional by global standards.

This speech was timely, given the recent piece in The Economist, which described Australian homes as the most overvalued in the world (the Economist says Australian housing is over-priced by 56 per cent) together with a Demographia report in which Australian cities again dominated the “severely unaffordable” category, with Adelaide now listed as the 8th least affordable major metropolitan centre in the seven nations surveyed (and higher on the list than both Perth and Brisbane).

Stevens’ comments immediately triggered another round in this long running debate, centred on the price versus income measure. The statement that “...it has not moved much either way for ten years” is difficult to reconcile with these graphs:

Even using the “average income” method it’s difficult to see how Stevens’ view can be reconciled with the data, but of more significance is the use of “average income” in the first place. This method, which has been used for some time in the Rismark/RP Data property price analyses, provides substantially different outcomes from a “median income” analysis used by other commentators, owing to the extent to which small numbers of very high income earners skew the average income figures. Average income data (as sourced through the ABS national accounts) also has potential issues with imputed rents and superannuation contributions, neither of which are of much use in the context of mortgage debt servicing.

In its recent report Demographia makes the point that:

This inappropriate practice [the use of average income] portrays Australian housing affordability as considerably more favourable than the reality, because average household incomes are materially higher than median household incomes. Average/median multiples and Median Multiples are not comparable.

Using Demographia’s methodology the picture is far less attractive:

On a city by city basis their data is as follows:

Same market, two very different stories. Who to believe?

But apparently not to the AOFM.

But apparently not to the AOFM.

![image[5] image[5]](http://lh4.ggpht.com/-ZBrv-NggXCI/UEcTAEW05wI/AAAAAAAAAPc/bjw4bb82nBA/image%25255B5%25255D%25255B15%25255D.png?imgmax=800) Following the trend of financial services firms using “inspirational” climbing themes to promote their wares (e.g.

Following the trend of financial services firms using “inspirational” climbing themes to promote their wares (e.g.