For an explanation of how this is calculated see here.

Things have improved a bit, but there's still some wild variances in forecasts for the cash rate, the biggest being a range of 2.75% to 4.75% for the Dec '09 rate.

An analysis of interest rates, the economy, a handful of economists, a randomiser, and the artist formerly known as Prince.

For an explanation of how this is calculated see here.

Things have improved a bit, but there's still some wild variances in forecasts for the cash rate, the biggest being a range of 2.75% to 4.75% for the Dec '09 rate.

I just stumbled upon the HousingPANIC blog. Now that the dire predictions that the blog focused on have come true the author has closed it down, but there's a ton of interesting stuff in there to look back on. Here's a couple of posts as a sampler:

Today the AFR has a major story on "how Suncorp was pulled from the fire." References to Queensland Inc and the desire of the Queensland political milieu to keep Suncorp as a "proud regional brand" abound. It's well worth a read.

...or maybe not. The September update of the tipsters league table showed ANZ leading the pack, with the narrowest of leads over my team. The size of the rate cuts since that time (1% in October, 0.75% in November and another 1% in December) have sent the "root mean square error" mechanism into overdrive. As the formula is particularly hard on forecasts that are very wide of the mark (courtesy of the squaring process) the overall error ratings of all the tipsters has blown out. In September ANZ led with an error rating of 0.339%. The new leader is Westpac on 0.624%, although its worth noting that both the Average and No Change tipsters have snuck into the outright lead.

It's not hard to see why we've all gone backwards so fast, and ANZ in particular. It was only a few months ago, in June 08, that a majority of the tipsters we track were calling for the cash rate - then at 7.25% - to be hiked. ANZ were particularly aggressive, calling for two hikes to 7.75% by December '08. The current rate of 4.25% leaves them a mere 3.50% adrift, with some pretty clear implications for the RMSE error calculator.

White House Conference on Minority Homeownership, Oct. 15, 2002

President Bush: Two-thirds of all Americans own their homes, yet we have a problem here in America because few than half of the Hispanics and half the African Americans own the home. That's a homeownership gap. It's a -- it's a gap that we've got to work together to close for the good of our country, for the sake of a more hopeful future. We've got to work to knock down the barriers that have created a homeownership gap.

I set an ambitious goal. It's one that I believe we can achieve. It's a clear goal, that by the end of this decade we'll increase the number of minority homeowners by at least 5.5 million families.

Some may think that's a stretch. I don't think it is. I think it is realistic. I know we're going to have to work together to achieve it. But when we do our communities will be stronger and so will our economy. Achieving the goal is going to require some good policies out of Washington. And it's going to require a strong commitment from those of you involved in the housing industry.

Just by showing up at the conference, you show your commitment. And together, together we will work over the next decade to enable millions of our fellow Americans to own a piece of their own property, and that's their home. ...

To open up the doors of homeownership there are some barriers, and I want to talk about four that need to be overcome. First, down payments. A lot of folks can't make a down payment. They may be qualified. They may desire to buy a home, but they don't have the money to make a down payment. I think if you were to talk to a lot of families that are desirous to have a home, they would tell you that the down payment is the hurdle that they can't cross.

"I and others were mistaken early on in saying that the subprime crisis would be contained. The causal relationship between the housing problem and the broad financial system was very complex and difficult to predict.

Clearly all that Jedi mind-control training was a waste of time.

As Citigroup thunders towards the precipice you can't help but cast your mind back to the wise words of its former Chairman and CEO, Charlie Prince, when describing the finer details of Citi's subprime strategy:

"When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing."

That was July '07, and things have certainly got a little complicated since then. Mind you, life for 50,000 Citi employees is about to get a lot simpler, as they'll be spared the grind of the daily commute. Chuck too will now have time to smell the roses - he's sailed off into the sunset with a UD$38 million golden goodbye. Still, with punditry like that who could quibble with $38m?

There are a lot of measures of market volatility around the place, such as the Chicago Board Options Exchange VIX index, which measures the volatility of S&P 500 index options.

The thought occurs to me that, for Weatherman purposes at least, we really need a measure of the volatility of the interest rate forecasts set out by the financial market gurus we track on this site.

As we've recorded these forecasts since January 2000 it was a simple matter of measuring the standard deviation of each set of forecasts, and summing them month by month.

The result is the DIX index, a name which suggested itself. As you can see it's been quite steady for years, and on several occasions hit zero as the forecasters were all in complete harmony.

Alas those days are long gone, with discord replacing harmony as it has with so many things.

Sounds good to me. The place gets plenty of snow and has some sweet runs. Ten lifts....four terrain parks....those central bankers sure know how to throw it down.

But what does it all mean? You can check it out here, or if you're more interested in sliding try here.

This is a rate cut!

The he-men at the Bank of England have kicked sand in the faces of Glenn Stevens and the rest of the 97lb weaklings at the RBA by cutting rates a whopping 1.50%.

Perhaps if we cut by 2% in December they'll back off a bit. Either that or the RBA boys sign up for one of those Charles Atlas programs.

Former Fed Chairman Alan Greenspan, pictured left, has made a remarkable back flip on the subject of regulation. Greenspan, a devotee of free-market capitalism and self-regulated financial markets, is reported to be "very distressed" that his ideology has proven to be flawed.

You're not alone there Al!

According to reports, Greenspan said his mistake was thinking that financial institutions would act in their own self-interest to avoid the kind of risky lending that could bankrupt them.

Looking at the size of the golden parachutes handed out to the big players on Wall Street, you could hardly rule self-interest out of the equation. In fact, with the wisdom of hindsight you could even say that self-interest would guarantee the sort of outcome we've had.

Michael West writing in The Age today makes a very interesting point in an article entitled "Waterloo for non-banks":

"Having said the banks were fine, it's clear someone tapped Kevin and Wayne on the shoulder and said, er...not all fine, actually."

My question is, if Kevin and Wayne were the tappees, who was the tapper? Call me paranoid if you will, but do I detect a certain amount of Queensland influence here?

I see that the Grey Men in Grey Suits have concluded that marking financial instruments to market isn't such a great idea after all, at least not when the market for those instruments disappears. See the Australian story here and the IASB press release here. Alas it's just a shade too late to help with the $700 bn of losses already booked.

I see that the Grey Men in Grey Suits have concluded that marking financial instruments to market isn't such a great idea after all, at least not when the market for those instruments disappears. See the Australian story here and the IASB press release here. Alas it's just a shade too late to help with the $700 bn of losses already booked.

Suggestions of bolting horses and stable doors.

It seems that organisations from the G7 to the BIS to the quaintly named Financial Stability Institute (a joint effort by the BIS and Basel people) are starting to point the finger at the accountants. The BIS notes that the accounting treatment may have overstated the losses on AAA sub-prime mortgage backed securities by as much as 50%.

All this to avoid the evils of profit smoothing!

Excellent article in the Economist, purporting to be from the risk manager of a large global bank. Click here to get there.

Excellent article in the Economist, purporting to be from the risk manager of a large global bank. Click here to get there.

Following on from my question posed in "Grey Men in Grey Suits" - namely, what impact the new accounting standards have had on the whole sub-prime/credit crunch fiasco, I was particularly interested to read this comment in the article:

Another lesson is to account properly for liquidity risk in two ways. One is to increase internal and external capital charges for trading-book positions. These are too low relative to banking-book positions and need to be recalibrated. The other is to bring back liquidity reserves. This has received little attention in the industry so far. Over time fair-value accounting practices have disallowed liquidity reserves, as they were deemed to allow for smoothing of earnings. However, in an environment in which an ever-increasing part of the balance-sheet is taken up by trading assets, it would be more sensible to allow liquidity reserves whose size is set in scale to the complexity of the underlying asset. That would be better than questioning the whole principle of mark-to-market accounting, as some banks are doing.

An interesting observation from Bernard Keane on Crikey. Click here for the full story.

Some thought low interest rates and profligate government spending were what got the world into the financial crisis. Turns out they’re apparently the solution, at least in Australia. Not so much to the financial crisis, though, but the economic crisis which is following hot on its heels.

Quietly contemplating the carnage currently besetting world financial markets, I found myself wondering what role in all this was played by the grey men (and women) behind the wonderful international financial reporting standards which have kept so many accountants so busy over the last few years.

Consider this. If a financial institution holds $100m of mortgage backed securities it records those securities on its balance sheet at market value. If market liquidity dries up, and the best price you can find for the securities is $50m, you write them down to that level and take a $50m hit through the P&L. Simple right?

But what if the underlying mortgages were still reasonably sound? What if a sensible assessment of the present value of the expected future cashflows was $80m? The accountants have been so desperate to avoid "profit smoothing" that they've driven the banks to write their investments down to market value where no market exists. No doubt there'll be a done of work to be done in sorting the mess out.

So the RBA cuts rates by 1% - the first time it's done such a thing since 1992 (when rates were much higher) and the market jumps in response.

Perhaps I'm getting paranoid but doesn't this suggest a degree of concern at the RBA that we haven't previously appreciated?

If anything, I would have thought that a cut of this magnitude would frighten the horses in a fairly big way.

This may be slightly off-topic, but I see that the RSPCA is setting a nationwide dragnet to catch the dickheads who filmed themselves beating a kangaroo senseless.

Could I suggest that they start their search at CBA's marketing department?

I've just been listening to RBA Governor Glenn Stevens giving his report to the House of Reps standing committee on economics. A copy of his crib notes is here. I must say the report was fairly uninspiring stuff, and I can't help thinking that what it really needs is some pizzazz, starting with the name of the presentation. At the moment it's presented as follows:

Title: House of Representatives Standing Committee: Economics (Reserve Bank of Australia Annual Report 2007) (HMS 9)

Contrast that with the US, where a similar report done by the Fed to Congress is known as the Humphrey-Hawkins testimony, so named for a couple of pollies (Gus Hawkins and Hubert Horatio Humphrey) who did the spadework on related legislation back in the 70's. How snappy is that?

Assuming we want to mimic the American approach (why not - we do everywhere else), what heroes of 1970's economic reform can we use? Lacking any pollies with "Horatio" in their name closes off that avenue of thought, but for economic events of earth-shaking significance it's tough to go past the Jim Cairns - Rex Connor - Tirath Khemlani loans scandal. Read about it here. It's got a bit of everything - the dreamy academic turned Federal Treasurer; the old school ALP/Communist Party man turned Federal Minerals & Energy Minister, the shadowy Pakistani banker with supposed access to billions of petrodollars, the Carlton Football Club (!) and last but by no means least the sultry private secretary romantically linked to Cairns. It's pure soap opera, and played no small part in the eventual dismissal of the Whitlam government.

|  |  |  |  |

| Cairns | Connor | Khemlani | Carlton | Morosi |

Yesterday's RBA rate cut didn't have a huge impact on the results of the tipsters below. However, ANZ did extend their lead a bit as my team were a bit slower in latching onto the rate cut story earlier in the year.

The thought occurs that we really need to get Bendigo Bank's forecasts into the mix. Anyone that can get away with the advertising campaign they had during the Olympics deserves attention!

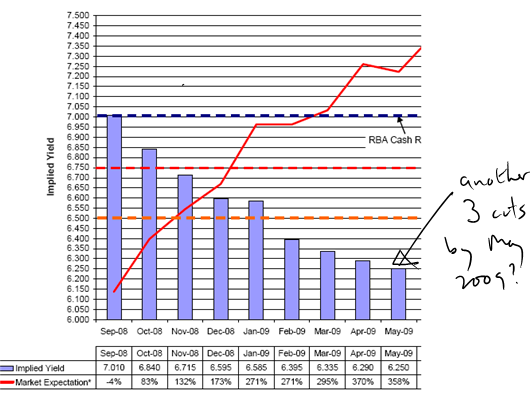

After seven years of relentless rate hikes the RBA has handed out a 0.25% rate cut with more to follow from reading the text of statement. Lots more, if you can believe the futures traders:

A timely article on Crikey immediately struck a chord (click it for the full text):

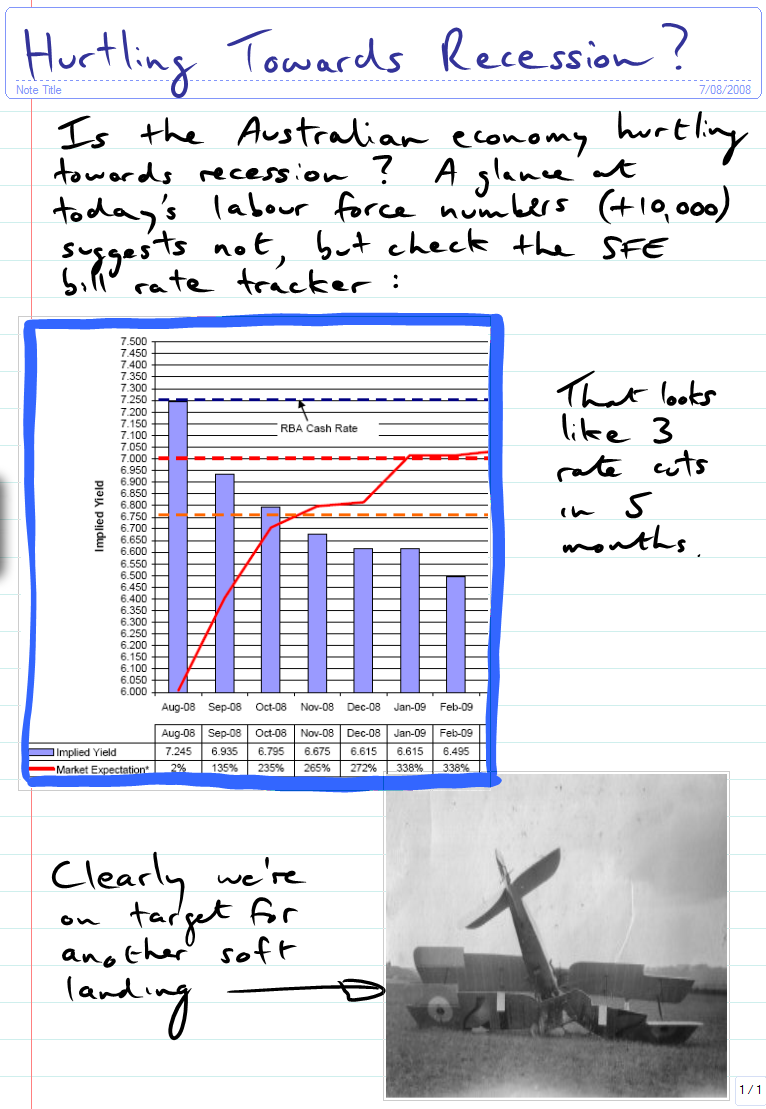

Hurtling Towards Recession? Is the Australian economy hurtling towards recession ? A glance at today's labour force numbers (+10,000) suggests not, but check the SFE Bill rate tracker: That looks like 3 rate cuts in 5 months. Clearly we're on target for another soft landing.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

More Kudos to ANZ. Hats off to the boys (and girls) at ANZ for making public a chart pack prepared for the Asset/Liability management committee. They do this each quarter, and it contains lots of good stuff, such as:

ANZ are one of the few (only?) forecasters calling for two more rate hikes, but note the subsequent plummet. And how long has it been since 90 day Bills were below cash?

While we're on the subject of kudos, the June '08 forecasting results are in, with ANZ again holding on to pole position:

[+/-] Hide/Show Text

[+/-] Hide/Show Text

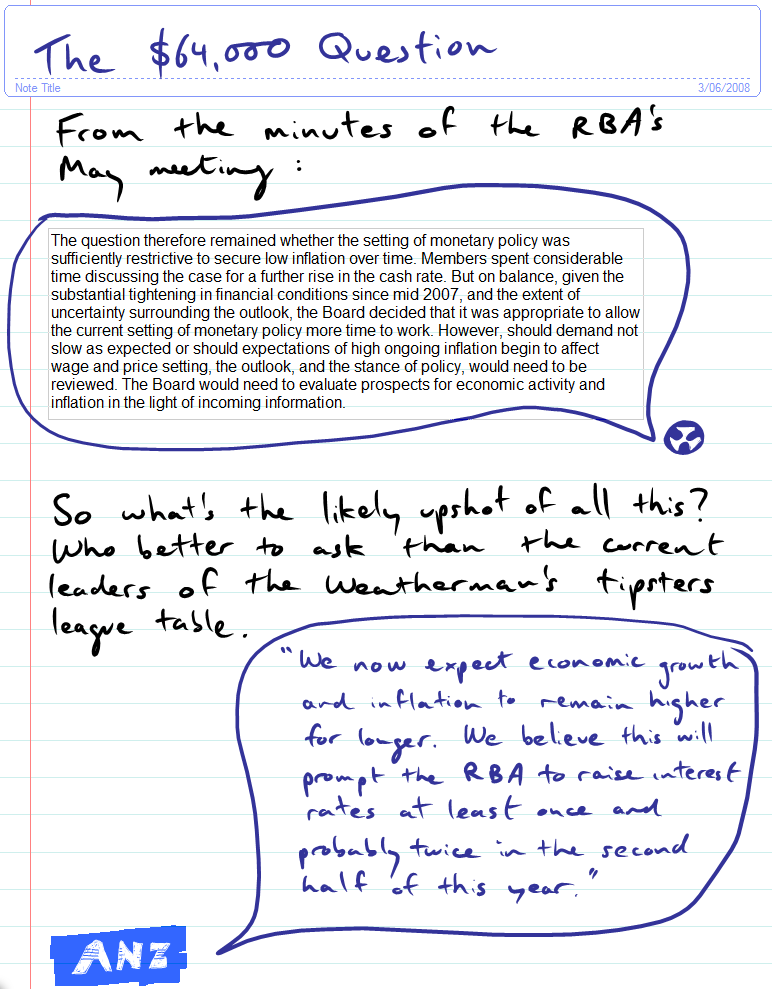

The $64,000 Question.

From the minutes of the RBA's May meeting: "The question therefore remained whether the setting of monetary policy was sufficiently restrictive to secure low inflation over time. Members spent considerable time discussing the case for a further rise in the cash rate. But on balance, given the substantial tightening in financial conditions since mid 2007, and the extent of uncertainty surrounding the outlook, the Board decided that it was appropriate to allow the current setting of monetary policy more time to work. However, should demand not slow as expected or should expectations of high ongoing inflation begin to affect wage and price setting, the outlook, and the stance of policy, would need to be reviewed. The Board would need to evaluate prospects for economic activity and inflation in the light of incoming information. So what's the likely upshot of all this? Who better to ask than the current leaders of the Weatherman's tipsters league table. "We now expect economic growth and inflation to remain higher for longer. We believe this will prompt the RBA to raise interest rates at least once and probably twice in the second half of this year." ANZ

[+/-] Hide/Show Text

[+/-] Hide/Show Text

Of Bulldogs and Budgets. Some time ago, Tim Colebatch (writing in The Age) proffered the opinion that a May rate rise was about as likely as a Bulldogs premiership. As the doggies were fetchin 50:1 at the time this seemed a bit far-fetched, but mark the following developments: -rates weren't hiked in May -odds on a Bulldogs flag now 11:1. If things keep going like this a rate hike and a Bulldogs premiership will be inevitable. Our new Federal Treasurer is doing his bit as well. The only really anti inflationary measures in his first budget were the repeated statements about how anti-inflationary it was. As a result, my money's still on a rate hike later in the year.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

The CBA PR Machine. Some nice coverage for the CBA in today's Age, suggesting that they may not follow the recent home loan rate rises pushed through by the other majors (including NAB's inspired ANZAC day hike). Have I missed something? Weren't CBA the first of the major banks to hike rates in this round, right after St George? I guess it's just another example of the power of CBA's PR folk, together with their kamikaze koalas.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

The most useless man in Australia? They better not be referring to Michael Clarke, who as we all know, is a dead set legend. - RBA Governor Stevens, on the other hard, seems to be some distance off dead set legend status, thanks to a tendency to meet alarming inflation numbers with interest rate increases. We wonder what will happen if today's off-the-scale PPI numbers (1.9% vs. market forecast of 1%.) translate into similar CPI numbers. What price another rate hike? Will the fear of adjectives even harsher than 'useless' steer the RBA in another direction? Or is Michael Clarke really to blame for all this?

[+/-] Hide/Show Text

[+/-] Hide/Show Text

Mission Accomplished

Great news! Apparently the war on inflation is over, with the RBA announcing its victory on 2/4/08. The high inflation number expected on April 23 will have no bearing on this, nor will mid-year tax cuts. The SFE rate tracker now has the prospect of a May rate hike at a paltry 10%. On the flipside, the odds of a Bulldogs flag have tightened to 31: 1, so the two are indeed coming together.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

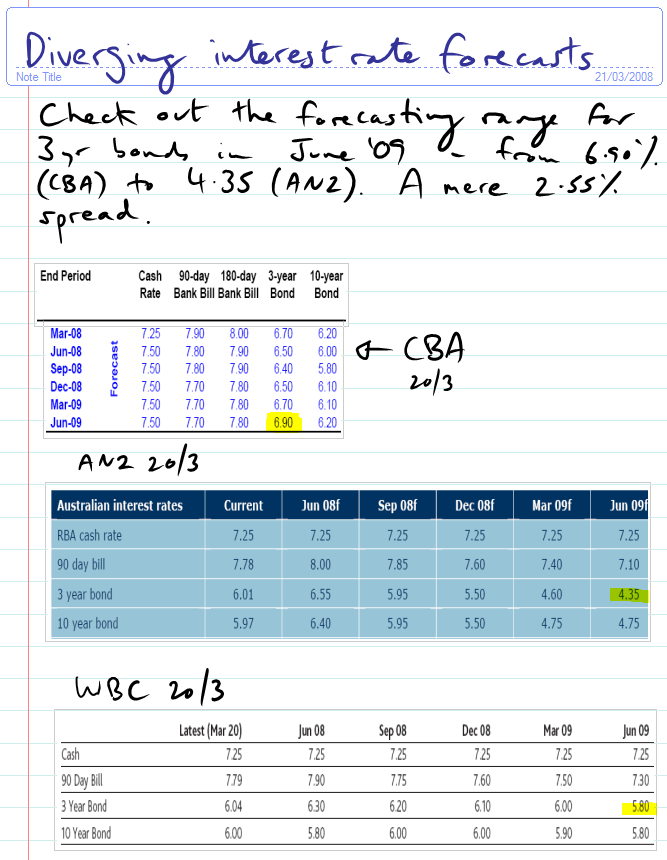

Diverging interest rate forecasts. Check out the forecasting range for 3 yr bonds in June '09 - from 6.90% (CBA) to 4.35% (ANZ). A mere 2.55% spread.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

Go the Doggies! Centrebet and Betfair currently have the Bulldogs at around 50.1. I suspect the odds on a May rate hike may be lower than that - a lot lower. Read The Age article here.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

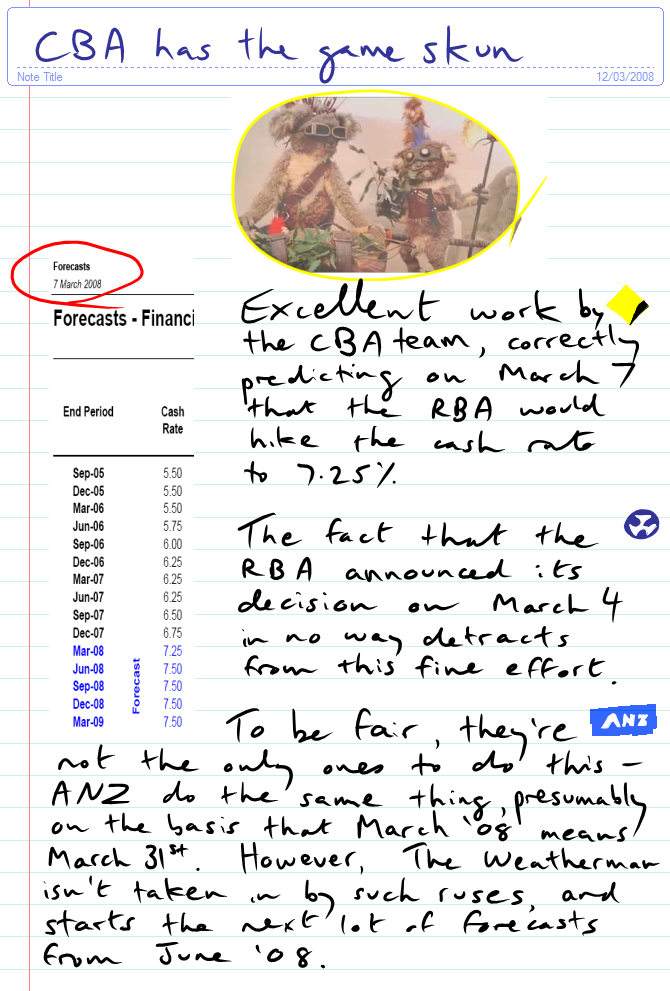

CBA has the game skun. Excellent work by the CBA team, correctly predicting on March 7 that the RBA would hike the cash rate to 7.25%. The fact that the RBA announced its decision on March 4 in no way detracts from this fine effort. To be fair, they're not the only ones to do this - ANZ do the same thing, presumably on the basis that March '08 means March 31st. However, The Weatherman isn't taken in by such ruses, and starts the next lot of forecasts from June '08.

[+/-] Hide/Show Text

[+/-] Hide/Show Text