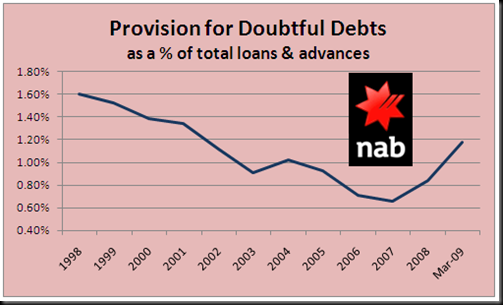

Chalk another one up to the men in grey. Amidst all the talk of the huge increases in NAB’s bad and doubtful debt provisioning, bear in mind that it’s just getting back to where it was before the bean counters decided that provisions were evil and may lead to the dreaded profit smoothing. They must be thrilled to bits with the volatility now apparent in bank reported earnings.

An analysis of interest rates, the economy, a handful of economists, a randomiser, and the artist formerly known as Prince.

Tuesday, April 28, 2009

Tuesday, April 7, 2009

2008 Snout/Trough Index – the big Kahuna

In my recent post covering the 2008 Snout/Trough index I kept my comparison to the four major banks, but the recent talk of paring back the cash bonuses payable to Macquarie Bank execs prompted me to add them to the list. Sure enough, they’ve left rest of the pack many lengths behind, storming into the lead with an incredible 60 page remuneration report, almost 90% of the overall Directors’ report. That’s right, they spend 60 pages talking about remuneration, and 7 pages talking about everything that isn’t remuneration.

| Bank | Remuneration Report pages | Remun Rpt as % of Directors’ Rpt |

| MBL | 60 | 90 |

| ANZ | 22 | 85 |

| CBA | 20 | 74 |

| NAB | 19 | 63 |

| WBC | 17 | 68 |

Make mine a Davidoff!

Subscribe to:

Comments (Atom)