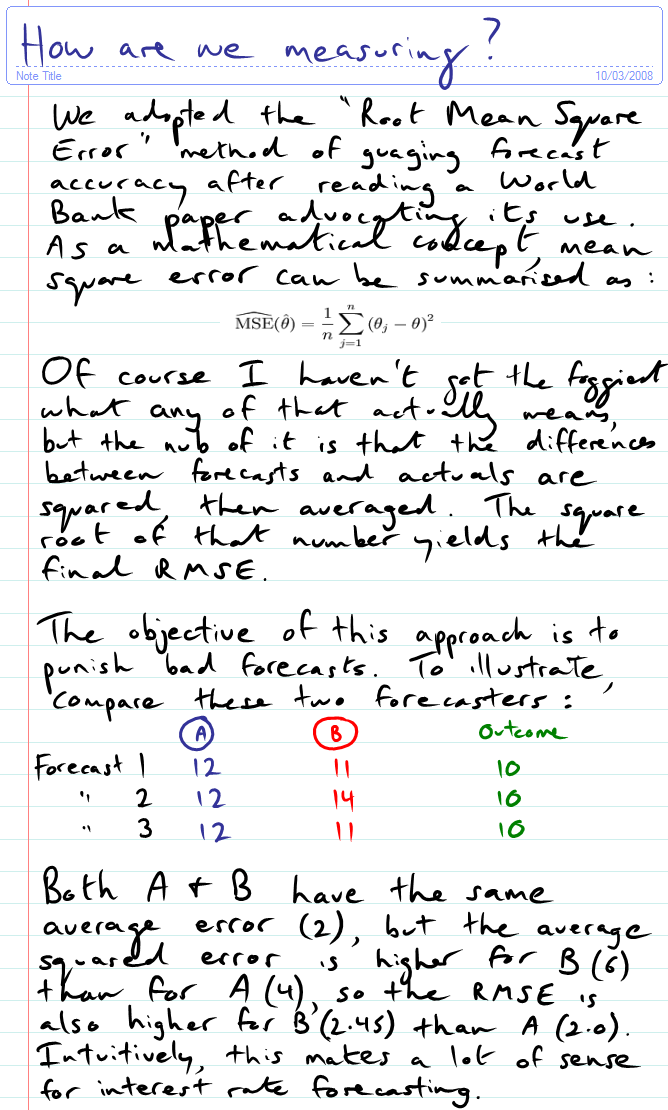

How are we measuring? We adopted the "Root Mean Square Error" method of gauging forecast accuracy after reading a World Bank paper advocating its use. As a mathematical concept, mean square error can be summarised as: Of course I haven't got the foggiest what any of that actually means, but the nub of it is that the differences between forecasts and actuals are squared, then averaged. The square root of that number yields the final RMSE. The objective of this approach is to punish bad forecasts. To illustrate, compare these two forecasters: Both A B have the same average error (2), but the average squared error is higher for B than for A (4), so the RMSE is also higher for B(2.45) than A (2.0). Intuitively, this makes a lot of sense for interest rate forecasting.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

No comments:

Post a Comment