An analysis of interest rates, the economy, a handful of economists, a randomiser, and the artist formerly known as Prince.

Friday, March 21, 2008

Sunday, March 16, 2008

Go the Doggies!

Go the Doggies! Centrebet and Betfair currently have the Bulldogs at around 50.1. I suspect the odds on a May rate hike may be lower than that - a lot lower. Read The Age article here.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

Wednesday, March 12, 2008

CBA has the Game Skun

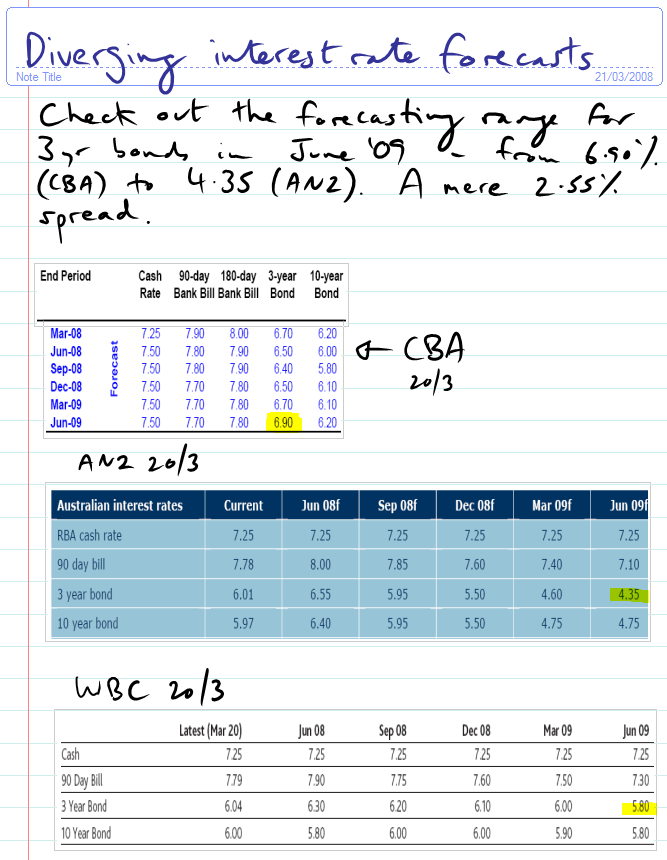

CBA has the game skun. Excellent work by the CBA team, correctly predicting on March 7 that the RBA would hike the cash rate to 7.25%. The fact that the RBA announced its decision on March 4 in no way detracts from this fine effort. To be fair, they're not the only ones to do this - ANZ do the same thing, presumably on the basis that March '08 means March 31st. However, The Weatherman isn't taken in by such ruses, and starts the next lot of forecasts from June '08.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

Tuesday, March 11, 2008

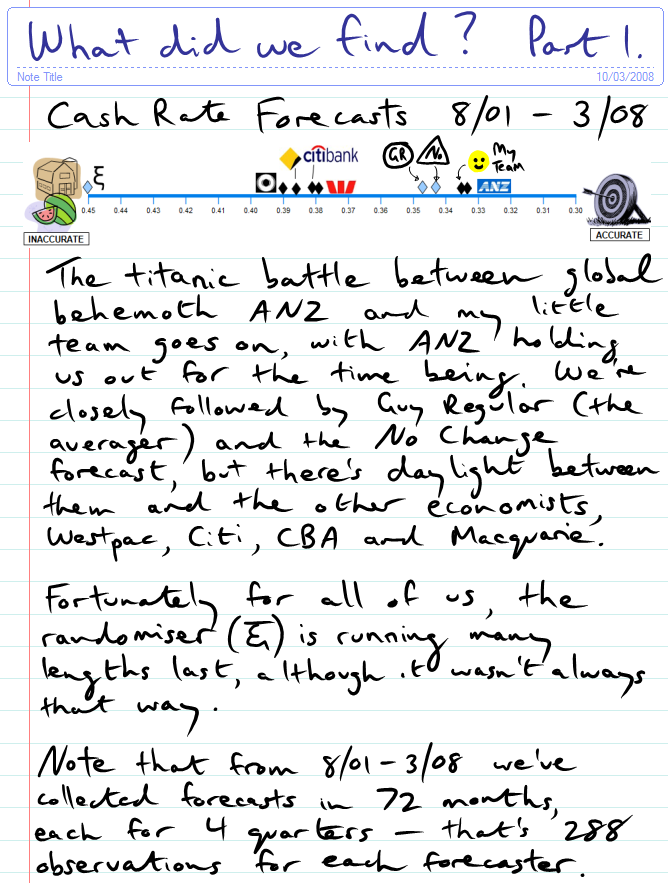

What did we find? (part 1)

What did we find? Part 1. Cash Rate Forecasts 8/01-3/08. The titanic battle between global behemoth ANZ and my little team goes on, with ANZ holding us out for the time being. We're closely followed by Guy Regular (the averager) and the No Change forecast, but there's daylight between them and the other economists, Westpac, Citi, CBA and Macquarie. Fortunately for all of us, the randomiser is running many lengths last, although it wasn't always that way. Note that from 8/01-3/08 we've collected forecasts in 72 months, each for 4 quarters - that's 288 observations for each forecaster.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

What did we find? (part 2)

What did we find? Part 2. Cash Rate Forecasts: 3 yrs to 3/08. ANZ has stormed into the lead, thanks to a stumble by long term leader Macquarie. Macca's insistence deep into 2007 that cash rates would be 6-25% in March 2008 has hurt them, as the Root Mean Square Error methodology is pretty harsh on 1% error rates. Looking forward, it's likely that ANZ will extend its lead next quarter, while Macquarie will slip further back in the pack.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

Monday, March 10, 2008

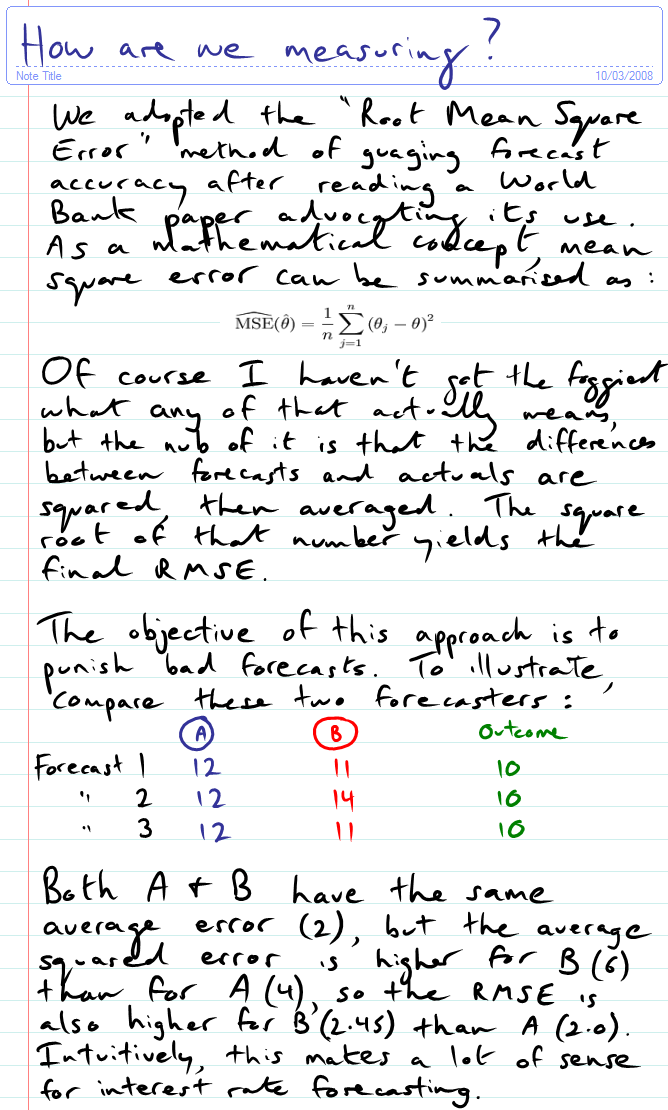

How are we Measuring?

How are we measuring? We adopted the "Root Mean Square Error" method of gauging forecast accuracy after reading a World Bank paper advocating its use. As a mathematical concept, mean square error can be summarised as: Of course I haven't got the foggiest what any of that actually means, but the nub of it is that the differences between forecasts and actuals are squared, then averaged. The square root of that number yields the final RMSE. The objective of this approach is to punish bad forecasts. To illustrate, compare these two forecasters: Both A B have the same average error (2), but the average squared error is higher for B than for A (4), so the RMSE is also higher for B(2.45) than A (2.0). Intuitively, this makes a lot of sense for interest rate forecasting.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

Who are we Measuring?

Who are we measuring? Most of the usual suspects: ANZ, Westpac, CBA, Citi & Macquarie. In addition, there's my team, a small group of dedicated individuals who combine fundamental economic analysis with the reading of goat's entrails to arrive at their forecasts. Finally there's the control group: No Change - a forecast that simply assumes that will stay where they are. X This could be the Greek letter Xi, representing a randomly generated set of forecasts. Alternatives, it could the forecasts of the artist formerly know as Prince. GR stands for Guy Regular, aka Joe Average. It's a simple average of the other forecasters.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

What are we Measuring?

What are we measuring? We're measuring the forecasting accuracy of a bunch of economists here in Australia. As you'd know, these people are flat out forecasting everything under the sun, pausing to rest only on the Sabbath and (presumably) bank holidays. Amongst the plethora of indicators available to us, one stands out as a clear benchmark: the Reserve Bank's official cash rate. This rate, like the Fed Funds rate in the US, is so central to everything that goes on in the financial markets that it's absolutely critical that you get it right. Or so you'd think. Anyway, cash rate forecasts are readily available, and are updated regularly. So, at the start of every month* we get the economists' forecasts for the cash rate for the next 4 quarters. *except January _ taking the RBA's lead (they don't meet January) we just ignore this month.

[+/-] Hide/Show Text

[+/-] Hide/Show Text

Sunday, March 9, 2008

So what's this all about?

So what's this all about?

You could be excused for thinking that interest rate forecasting is the exclusive domain of the big bank economists. They get the big bucks, the media attention, the groupies - you name it. But you'd be wrong. Your guess is every bit as good as theirs, as these pages will endeavour to prove.

Why the Weatherman? Why not? Inspired of course by the famous line penned by Bob Dylan- "You don't need a weatherman to know which way the wind blows" What better aphorism for the dismal science could you want?

[+/-] Hide/Show Text

[+/-] Hide/Show Text