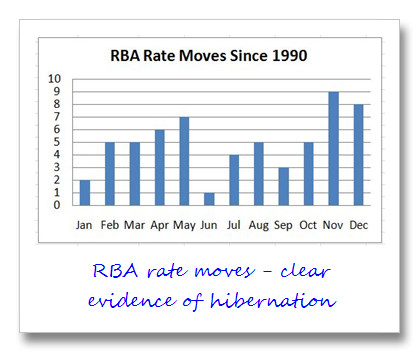

Amidst all the shock and horror concerning the RBA’s surprise rate increase on Melbourne Cup day (and the attendant hysteria when CBA subsequently chimed in with a 0.45% increase in its home loan rate), it’s worth reflecting that over the last 20 years the RBA has changed rates in November almost as many times as they’ve left them alone. In nine years out of the 21 they’ve changed rates in November (six of these have been rate hikes), including the last 5 consecutive years. In fact, the last time the RBA left rates alone on Melbourne Cup day Makybe Diva was still showing the competition a clean pair of heels (2005).

Looking at the data, it’s fairly clear that November and December are the prime season for rate changes, presumably owing to the proximity of Christmas and the immediate impact on spending. Contrast June – one rate move in the last 21 years (a hike to 4.75% in June ‘02). What’s that all about? Do they hibernate in winter? There’s been more activity in January, and the RBA stopped meeting in January donkey’s years ago.