More Kudos to ANZ. Hats off to the boys (and girls) at ANZ for making public a chart pack prepared for the Asset/Liability management committee. They do this each quarter, and it contains lots of good stuff, such as:

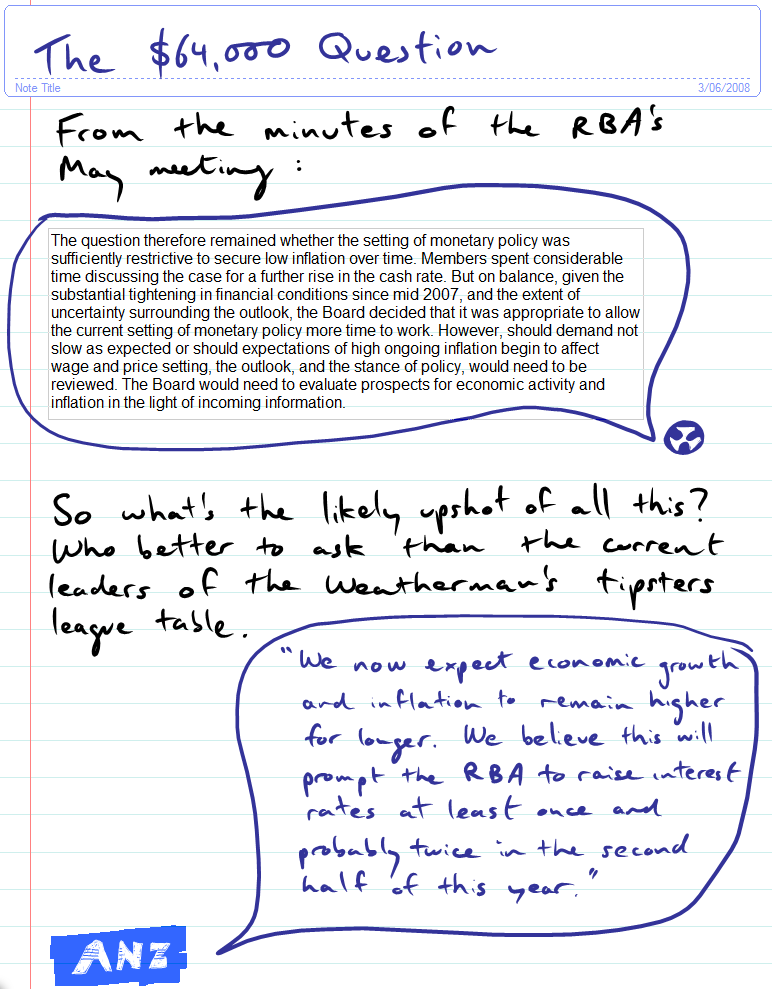

ANZ are one of the few (only?) forecasters calling for two more rate hikes, but note the subsequent plummet. And how long has it been since 90 day Bills were below cash?

While we're on the subject of kudos, the June '08 forecasting results are in, with ANZ again holding on to pole position:

[+/-] Hide/Show Text

[+/-] Hide/Show Text