ANZ’s spectacular fall down the tipsters’ league table continues apace.

Bear in mind that ANZ were leading this competition less than two years ago, neck and neck with my own erstwhile team, with daylight back to the others:

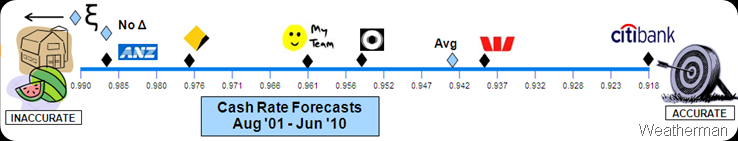

Contrast that with today’s chart:

So what’s the reason for the dramatic fall from grace? Could it be “the curse of Saul Eslake”, in the same way that “the curse of the Bambino” plagued Boston after Babe Ruth was traded to the Yankees?

Looking at the data, in September 2008 everyone got it spectacularly wrong, as the severity of the GFC and the scale and speed of the monetary policy response took everyone by surprise:

| Sep ‘08 Forecasts | Dec ‘08 | Mar ‘09 | Jun ‘09 | Sep ‘09 |

| ANZ | 6.75 | 6.75 | 6.50 | 6.25 |

| Citibank | 6.75 | 6.50 | 6.50 | 6.50 |

| Actual Cash Rate | 4.25 | 3.25 | 3.00 | 3.00 |

Variances of 3.5% between forecasts and actuals are obviously going to knock the stuffing out of the results (compare the scale of the 9/08 table with that of 6/10) but don’t explain the relative difference between ANZ and Citi. For that we need to look at the mid-‘09 forecasts.

| Jul ‘09 Forecasts | Sep ‘09 | Dec ‘09 | Mar ‘10 | Jun ‘10 |

| ANZ | 3.00 | 2.50 | 2.50 | 2.50 |

| Citibank | 3.00 | 3.25 | 3.75 | 4.25 |

| Actual Cash Rate | 3.00 | 3.75 | 4.00 | 4.50 |

It’s here that we find the answer – ANZ’s dyspeptic view of the world persisted longer than others, leaving it exposed to 1.50 – 2.00% variances. Given the “squared error” approach to variances that the Weatherman prefers, this has had some fairly dramatic consequences for the overall score. Oh, and as Saul wasn’t traded until August 2009 it’s fair to say that the rot had already well and truly set in, so forget about the curse!